In this article you will get yo know about RVNL Share Price Target 2025 To 2030. Here, you will get the complete analysis about the share and will be provide target prices from the year 2025 to 2030. Here, we will see the market and fundamentals of the share and analyze it through financial and income report, price chart and share holding pattern from the previous year by which you will get and idea about the future of the share.

Table of Contents

Rail Vikas Nigam Limited

Rail Vikas Nigam is a public sector undertaking under the Ministry of Indian Railway. It is a government owned company. It was established in the year 2003 it’s first goal is to make fast rail infrastructure project. It include big projects that work for developing and betterment of the railway. For more information you can visit https://rvnl.org/.

RVNL Fundamentals and Market Overview

- 52 Week High: ₹647.00

- 52 Week Low: ₹165.60

- Volume: 1,13,48,824

- Market Capital: ₹95,619Cr

- ROE: 15.33%

- Book Value: ₹42.17

- Face Value: ₹10

- EPS(TTM): ₹6.46

- P/E Ratio(TTM): 70.99

- Industry P/E:35.72

- Dividend Yield: 0.46

- Debt to Equity: 0.62

RVNL Share Price Chart

RVNL Share Price Target 2025 to 2030

| RVNL Share Price Target Years | Share Price Target (₹) |

| 2025 | ₹890 |

| 2026 | ₹1077 |

| 2027 | ₹1270 |

| 2028 | ₹1480 |

| 2029 | ₹1655 |

| 2030 | ₹1867 |

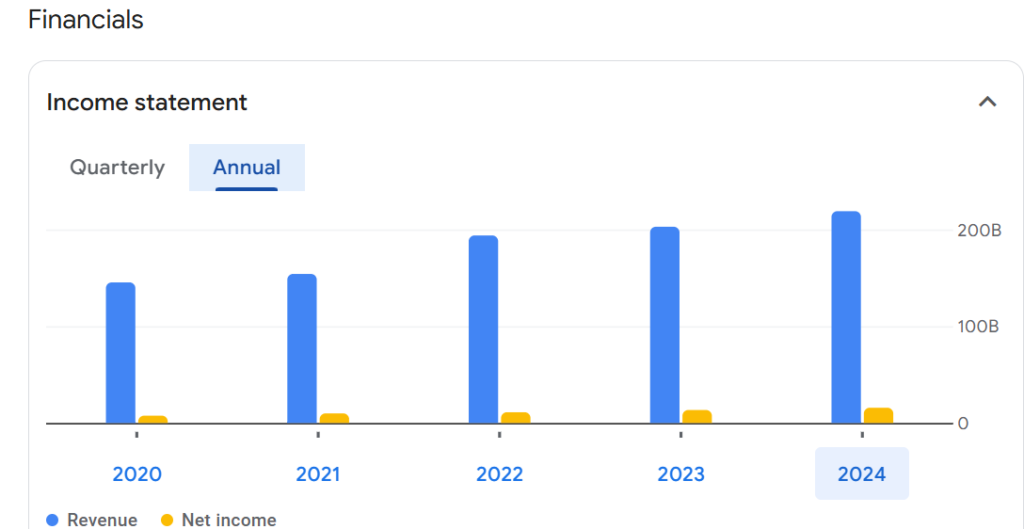

RVNL Financial and Income Statement

| (INR) | 2024 | Y/Y change |

| Revenue | 218.89B | 7.93% |

| Operating expense | 3.50B | 3.64% |

| Net income | 15.74B | 17.33% |

| Net profit margin | 7.19 | 8.61% |

| Earnings per share | 7.55 | — |

| EBITDA | 13.65B | 10.72% |

| Effective tax rate | 23.34% | — |

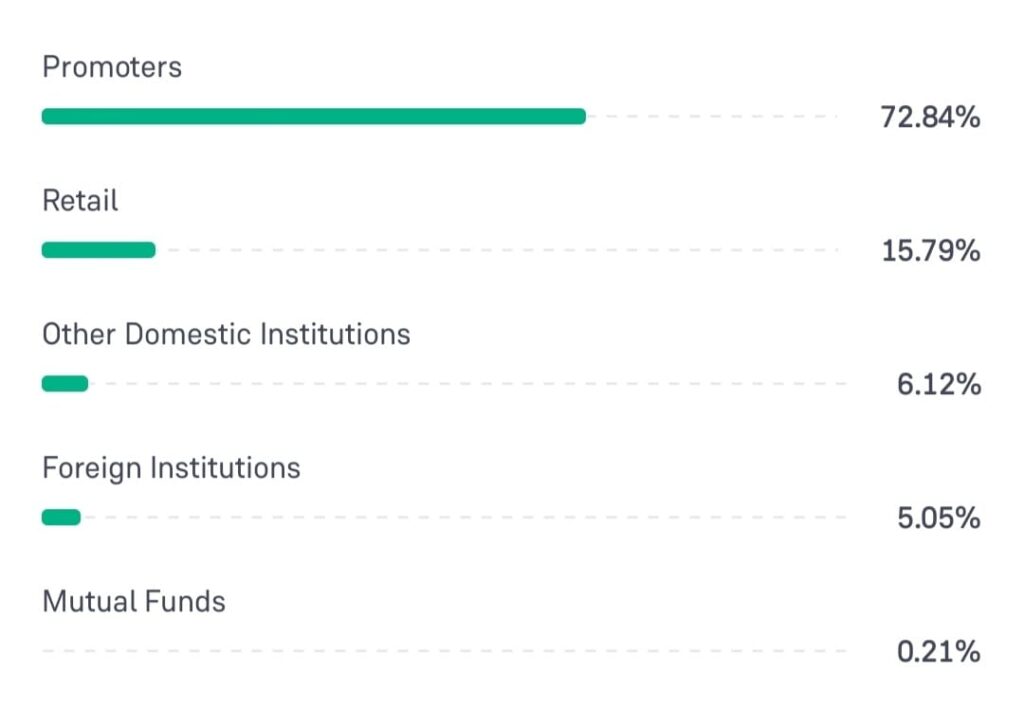

Share Holding Pattern of RVNL

- Promoters: 72.84%

- Retail: 15.79%

- Other Domestic Institutions: 6.12%

- Foreign Institutions: 5.05%

- Mutual funds: 0.21%

RVNL Share Price Target 2025

RVNL share price target 2025 the expected price is ₹890.

Here are the key aspects affecting the growth of RVNL in 2025.

- Government Infrastructure Projects: RVNL being an organization owned by the government is benefitting from increased subsidies on the spending of the government in the infrastructure sector. Greater investment on railway expansion, railway up-graduation, and metro works are expected to create confidence in the investors.

- Railway Sector Reforms: Some potential reforms in Indian railway area like monetization of some activities or increasing the operational efficiency could be a risk to RVNL in terms of its growth and stock appreciation.

- Global Economic Conditions: Recession-free post-pandemic global order and economic regime willing to extend all favorable conditions would encourage investors and globalization would indirectly support RVNL’s performance especially if there is stability in commodity exchanges and world trade.

RVNL Share Price Target 2026

RVNL share price target 2026 the expected price is ₹1077.

Here are the key aspects affecting the growth of RVNL in 2026.

- Project Execution and Timeliness: RVNL forming part of the railway sector and railways being a timeline driven industry, timely executions of the projects and being able to control the costs would be crucial in strengthening their position in the stock market. Set backs in key projects (bullet trains and metro lines) could disillusion the investors.

- Cost Control and Profit Margins: Strategic cost controls particularly on some materials and labor would turn the profitability upwards and may be a major factor for the share price.

RVNL Share Price Target 2027

RVNL share price target 2027 the expected price is ₹1270.

Here are the key aspects affecting the growth of RVNL in 2027.

- Public-private partnership in Railway Projects: A greater involvement in the public-private partnership (PPP) models in railway projects can hand RVNL some profitable contracts which in turn has a positive effect on the share price.

- Technological enhancement: RVNL can do a number of technological upgrades in railway systems including automation, digitization and AI which can improve the efficiency of operations as well as its growth potential.

- Inflation and interest rates: Higher inflation or increasing interest rates could rise the cost of borrowing money which in turn would reduce the profitability. This is particularly true for RVNL given its huge investments in infrastructure development projects.

RVNL Share Price Target 2028

RVNL share price target 2028 the expected price is ₹1480.

Here are the key aspects affecting the growth of RVNL in 2028.

- Strategic International Projects: Growth of international presence of RVNL new revenue sources in the infrastructure projects in neighboring countries like Sri Lanka, Nepal, and Bangladesh; and positively affect the company’s share price.

- Performance of Indian Railways: RVNL being the main player in the railways industry, improvement in the Indian Railways, in particular punctuality and the volume of passengers carried will in the end also enable the growth of RVNL.

- Government’s Fiscal Health: The position of the Indian government in terms of its finances and the budgetary portions for infrastructure including documents, will be fundamental to RVNL’s growth and stock performance in the future.

RVNL Share Price Target 2029

RVNL share price target 2029 the expected price is ₹1655.

Here are the key aspects affecting the growth of RVNL in 2029.

- Green Bonds and Sustainable Financing: If RVNL raises fund through the green bonds or any other sustainable financing options, it can market itself as an environment friendly investment which will help in wooing ESG investors.

- Digital Transformation: Building upon the preceding paragraph, further and additional developments in digitalization and application of smart systems into railway processes could enhance efficiency, optimization of costs, which results in improved earnings and increases in the stock price.

- Political Stability and Regulatory Environment: Any ‘shocks’ like moderate or major policy changes of governments in power for example change of political party in power, or regulatory control over the public infrastructure sector might alter the confidence of the investors of RVNL.

RVNL Share Price Target 2030

RVNL share price target 2030 the expected price is ₹1876.

Here are the key aspects affecting the growth of RVNL in 2030.

- Completion of Major Milestones: Achieving targets like completion of high speed rail corridors, or completing the metro network of cities would be an important factor for RVNL in achieving its financial targets and its stock price would also increase.

- Domestic and International Demand for Infrastructure: An improved economic scenario in India and the need for improved transportation facilities might accelerate RVNL’s further growth, which should also result in a rise in its stock price.

- Technological and Innovation Leadership: People might expect that Raja National Limited will lead the rail or rail based transport market by 2030. All these advancements like high speed train, electric tracks and many others.

FAQ

What is the share price of RVNL in 2025?

RVNL share price is likely to be ₹890 in 2025.

What is the share price of RVNL in 2030?

RVNL share price is likely to be ₹1867 in 2030.

What is the share price of RVNL in 2026?

RVNL share price is likely to be ₹1077 in 2026.