In this article you will get to know LIC Share Price Target 2025 to 2030. Here, you will be provided the complete analysis of the share. By analysis of market, fundamentals, financials, income report and share holding pattern.

Table of Contents

LIC

Life Insurance Corporation of India (LIC) is an insurance company of the government of India and it came into existence on 1st September, 1956 as a result of the enactment of Life Insurance Corporation of India Act. It is one among the top and most respected life insurance services in India and has a large portion of the Indian market of insurance business. For more information you can visit official website https://licindia.in/.

LIC Fundamentals and Market Overview

- 52 Week High: ₹746.30

- 52 Week Low: ₹1,222.00

- Volume: 14,32,458

- Market Capital: ₹5,73,235Cr

- ROE: 42.53%

- Book Value: ₹154.36

- Face Value: ₹10.

- EPS(TTM): ₹65.65

- P/E Ratio(TTM): 13.81

- Industry P/E: 17.60

- Dividend Yield: 1.10%

- Debt to Equity: 0.00

LIC Share Price Chart

LIC Share Price Target 2025 to 2030

| LIC Share Price Target Years | Share Price Target (₹) |

| 2025 | ₹1178 |

| 2026 | ₹1245 |

| 2027 | ₹1348 |

| 2028 | ₹1470 |

| 2029 | ₹1515 |

| 2030 | ₹1640 |

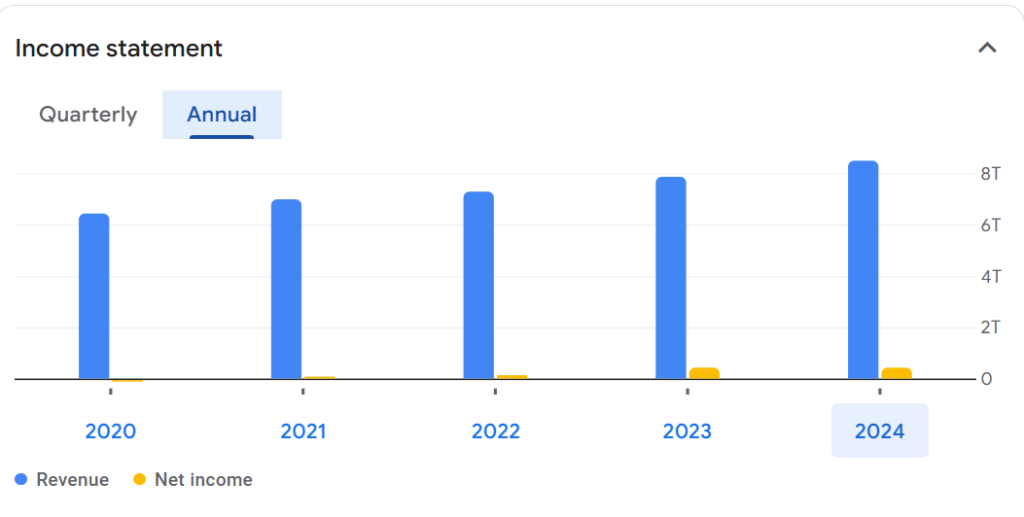

LIC Financial and Income Statement

| (INR) | 2024 | Y/Y change |

| Revenue | 8.48T | 7.99% |

| Operating expense | 397.58B | -14.11% |

| Net income | 424.29B | -0.57% |

| Net profit margin | 5.00 | -7.92% |

| Earnings per share | 64.31 | 13.00% |

| EBITDA | 470.77B | 73.84% |

| Effective tax rate | 12.56% | — |

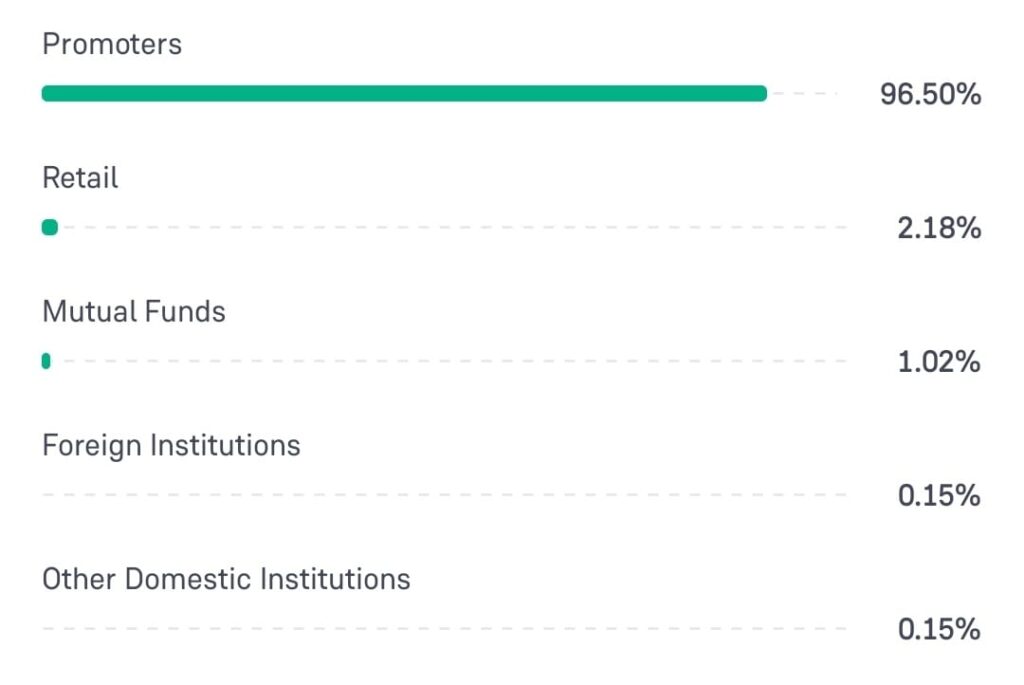

Share Holding Pattern of LIC

- Promoters: 96.50%

- Retail: 2.18%

- Mutual funds: 1.02%

- Foreign Institutions: 0.15%

- Other Domestic Institutions: 0.15%

LIC Share Price Target 2025

LIC share price target 2025 the expected price is ₹1178.

Here are the key aspects affecting the growth of LIC in 2025.

- Post-IPO Performance: The shares of LIC have been trading for a varying amount of time and given the sentiment of the investors as well as the post stabilization of the IPO once it was released in 2022, they are looking at positive growth for the future with 2025 being their target year.

- Regulatory Environment: Looking at the current state of the economy it is safe to say that the measures proposed by the government such as those towards the insurance and financial spheres directly impacts the business of LIC and its plans in moving forward. Also, based on moving forward with policies in the insurance sector addressing aspects such as tax cuts, solvency ratios, and government policies will also have an effect.

- Digital Transformation and Technological Advancements: The competition that LIC might otherwise face from private firms, its readiness to move towards digital technology, use mobile applications, and employ technology for customer engagement and support, will solve that problem.

LIC Share Price Target 2026

LIC share price target 2026 the expected price is ₹1245.

Here are the key aspects affecting the growth of LIC in 2026.

- Growth in Premium Income and Market Share: Considering the position that LIC is in, being able to increase its premium income while maintaining the market share will be the factor that drives the share prices by 2026.

- Macroeconomic Factors: The rise in the economy, inflation, and interest rates will be quite significant to LIC. Disposable income levels could increase the demand for insurance products if the economy continues to grow, while inflation or higher interest rates could reduce profitability.

- Profitability and Dividend Policy: The conscious decision makers of LIC will have to consider how to manage their profits that are reported on a quarterly basis as well as annual some balance in achieving the set objectives as this will have an overall influence on the share prices of the company.

LIC Share Price Target 2027

LIC share price target 2027 the expected price is ₹1348.

Here are the key aspects affecting the growth of LIC in 2027.

- Competition from Private Insurers: Private insurers are likely to grow increasingly more aggressive. How LIC responds to competition and its ability to construct new products and market them will be significant.

- International Expansion: However, LIC’s overseas expansion plans, especially in developing territories are likely to complement its growth and enhance revenue. This will increase the valuation of the company as well. The performance of LIC’s foreign ventures will affect the stock prices.

- Claims Ratio and Risk Management: The other apart from the claim ratio that would be important aspect is the overall management of underwriting risk, where the customers are on the increase.

LIC Share Price Target 2028

LIC share price target 2028 the expected price is ₹1470.

Here are the key aspects affecting the growth of LIC in 2028.

- Sustainability and ESG Factors: Environmental, Social and Governance(ESG) factors are likely to come into prominence. LIC’s performance on sustainable investment as well as social corporate responsibility may appeal to investors which in turn will boost its share price.

- Investment Performance: Investment performance particularly in Indian equity markets will impact its earnings as well as the stock price.

- Brand Loyalty and Customer Trust: LIC brand which has been established over a period of more than 50 years will be of paramount importance. The company should advertise more and target LIC’s younger customers, so that the business will remain stable and grow.

LIC Share Price Target 2029

LIC share price target 2029 the expected price is ₹1515.

Here are the key aspects affecting the growth of LIC in 2029.

- Strengthening of the Competitive Position: In India’s insurance market, LIC will expand its stronghold, which it may have done further by 2029.

- Regulatory Measures and Assistance: Concerning policy support for the insurance market, in particular, the government’s policies impacting the LIC will remain relevant. If insurance density needs to be increased and the government comes out with some measures to improve penetration, it could benefit LIC excessively.

- Change in Work Ethics Due to Digitalization: Operating licensing efficiency and profitability will be determined by the rate of deployment of Artificial Intelligence (AI), Machine Learning (ML) and other technologies by LIC into its underwriting, claims, and customer care services.

LIC Share Price Target 2030

LIC share price target 2030 the expected price is ₹1640.

Here are the key aspects affecting the growth of LIC in 2030.

- Entering New Areas Of Business: By 2030, LIC may have expanded forward into health insurance and backward into asset management, pension businesses also.

- Trends and Cycles in the Global Economy: Aspects including international relations and trade relations, Strategic Currency relations, and global inflation remain issues for LIC’s international businesses and its investments and growth in the future.

- Social and Cultural Transformation: The Indian demographic perspective or rather trends like the expansion of middle-class, increasing urban population, and aging population among others will be important.

FAQ

What is the share price of LIC in 2025?

LIC share price is likely to be ₹1178 in 2025.

What is the share price of LIC in 2030?

LIC share price is likely to be ₹1640 in 2030.

What is the share price of LIC in 2026?

LIC share price is likely to be ₹1245 in 2026.