In this article you will get to know about ICICI Bank Share Price Target 2025 To 2030. Here, you will get the complete analysis and information of the share. You will get to know about share price chart, market overview, fundamentals and share holding pattern. By which you will get to know about the future of the ICICI Bank share price.

Table of Contents

ICICI Bank Ltd.

About ICICI Bank, it is a well-established private sector Indian bank with operations in multiple regions providing a variety of banking and other services to retail customers, business and corporate clients. Established in 1994, the bank has grown tremendously and has a good coverage of the urban and rural sectors. The bank provides services which includes retail, corporate, investment, and wealth banking. It has a well-developed infrastructure as well as online banking, mobile applications and ATM services. Founded in 1994, ICICI Bank has combined with the best operations on the financial market and provides clients with advanced banking services and products. In addition, the bank has the diversification of its loan portfolio and a good financial position. The company’s commitment to accepted standards of governance and sustainability allows it to be a significant figure among Indian banks. For more information you can visit official website https://www.icicibank.com/ .

ICICI Bank Fundamentals and Market Overview

- 52 Week High: ₹1,362.35

- 52 Week Low: ₹970.15

- Volume: 1,35,36,684

- Market Capital: ₹9,49,306Cr

- ROE: 17.20%

- Book Value: ₹390.12

- Face Value: ₹2

- EPS(TTM): ₹67.12

- P/E Ratio(TTM): 20.4

- Industry P/E: 13.76

- Dividend Yield: 0.74%

- Industry P/E: 13.76

- Debt to Equity: NA

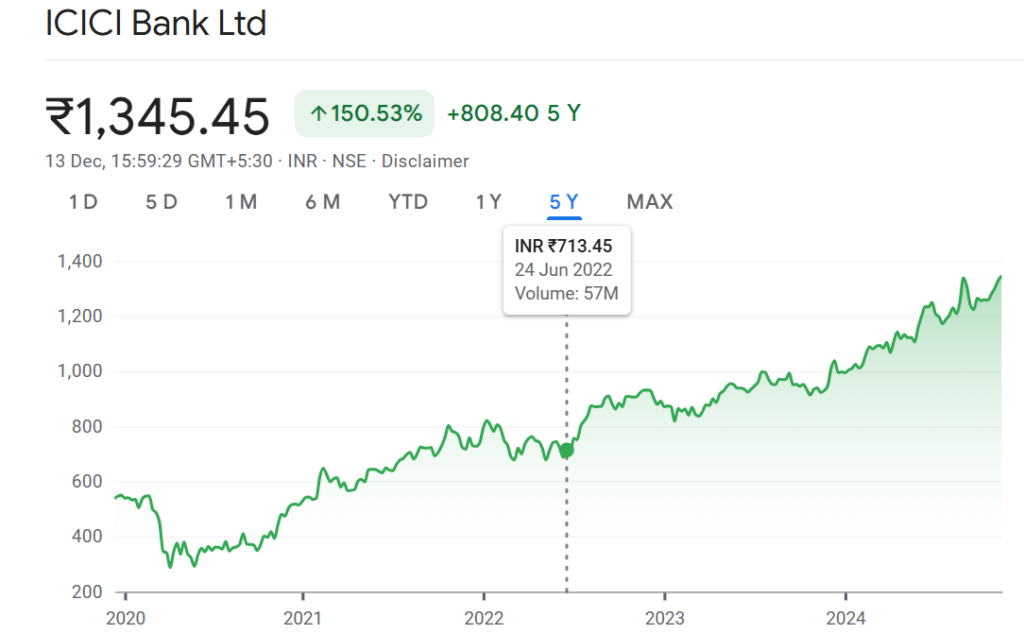

ICICI Bank Share Price Chart

ICICI Bank Share Price Target 2025 to 2030

| ICICI Bank Share Price Target Years | Share Price Target (₹) |

| 2025 | ₹1480 |

| 2026 | ₹1589 |

| 2027 | ₹1699 |

| 2028 | ₹1890 |

| 2029 | ₹2050 |

| 2030 | ₹2205 |

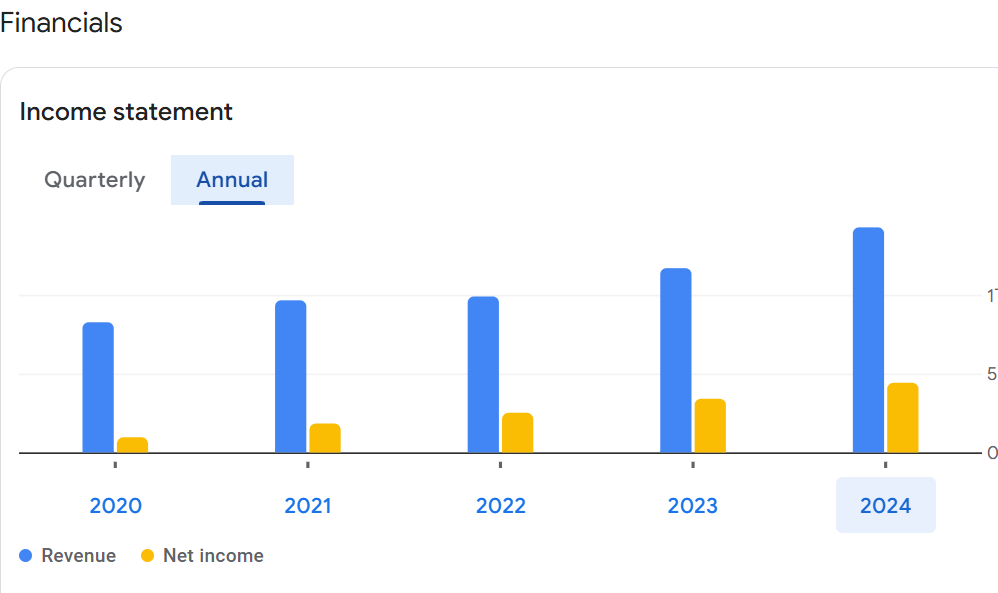

ICICI Bank Financial and Income Statement

| (INR) | 2024 | Y/Y change |

| Revenue | 1.43T | 22.14% |

| Operating expense | 977.83B | 18.61% |

| Net income | 442.56B | 30.03% |

| Net profit margin | 30.99 | 6.42% |

| Earnings per share | 61.96 | 5,563.00% |

| EBITDA | — | — |

| Effective tax rate | — | — |

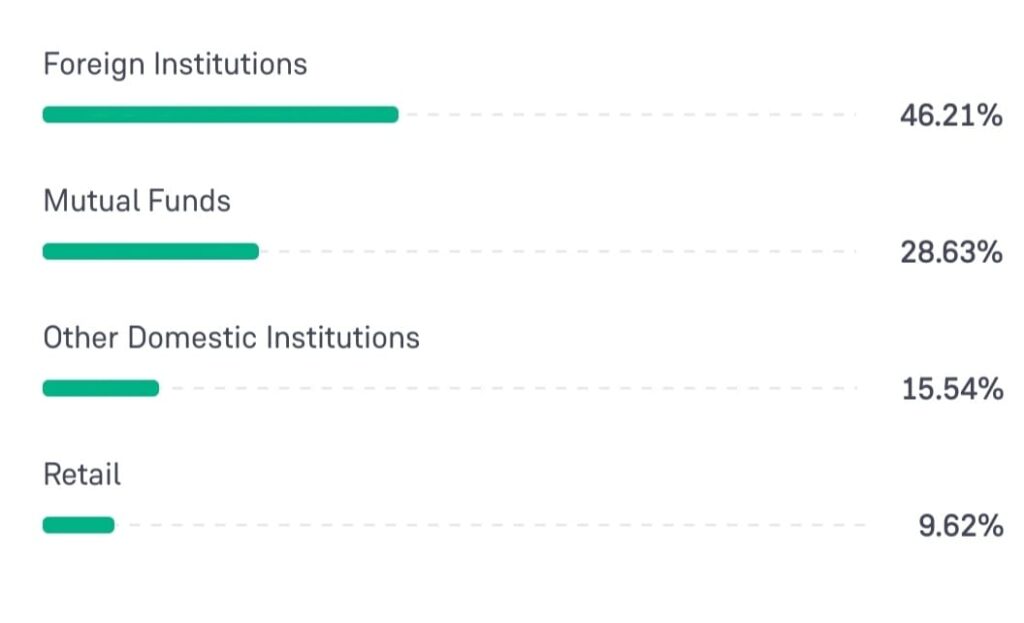

Share Holding Pattern of ICICI Bank

- Foreign Institutions: 46.21%

- Other Domestic Institutions: 15.54%

- Mutual funds: 28.63%

- Retail: 9.62%

ICICI Bank Share Price Target 2025

ICICI Bank share price target 2025 the expected price is ₹1480.

Here are the key aspects affecting the growth of ICICI Bank in 2025.

- Economic Growth and Interest Rates: In the event that India is in a period of growth, the demand for loan facilities may increase, resulting in ICICI Bank increasing its revenues. Increased interest rates on the other hand may lead to high borrowing cost which will reduce the banking profit margins.

- Digital Transformation: ICICI Bank’s ability to develop and implement suitable strategy for digital banking, fintech partners acquisition and incorporating technology will be vital. Should the bank successfully implement the technological systems, the outcome will be enhanced clients’ satisfaction, increased acquisition of new clients, and cost savings.

- Asset Quality and NPA Trends: The quality of ICICI Bank’s loan book should be critical. Any reduction in non-performing assets (NPAs) as well as enhancement of other parameters of asset quality will instill higher confidence among investors, while increases in bad loans will have adverse effects on share performance.

ICICI Bank Share Price Target 2026

ICICI Bank share price target 2026 the expected price is ₹1589.

Here are the key aspects affecting the growth of ICICI Bank in 2026.

- Global Economic Conditions: It is possible for the combination of world’s inflation rate, political instability or unrest, or economic recession, to impact the imports and exports of India, including foreign capital. A decline in the global economy and growth rates may negatively impact the earnings of the bank.

- Regulatory Changes: Considerable changes in the laws put in place by the Reserve Bank of India (RBI) with regard to a bank’s capital sufficiency, lending capacity and risk would most likely influence the functions of ICICI Bank.

- Network of Branch Locations: By continuing to rationalize its physical branch network, together with expanding into tier-2 and tier-3 cities, ICICI Bank may be able to reach new customers hence increasing prospects in retail banking. While expanding into new areas does enhance the number of potential customers, it is not sufficient alone to explain growth in retail banking.

ICICI Bank Share Price Target 2027

ICICI Bank share price target 2027 the expected price is ₹1699.

Here are the key aspects affecting the growth of ICICI Bank in 2027.

- Global Economic Conditions: The Indian banking sector has four fundamental aspects, where the global economic performance acts as the latter. Also, trade relations, oil prices and geopolitical landscapes are said to be important as Indian banks performance is linked to these. and Such a strong global economy can then be expected to have a positive impact on the Indian financial services sector as a whole and ICICI Bank in particular.

- Government Initiatives: Any country’s growth engines are the SMEs and start ups, and proper government policies for enhancing financial inclusion, infrastructure spending and banking reforms should provide a favorable environment in which ICICI Bank can open new business verticals.

- Raising of Additional Funds: Should ICICI Bank raise additional capital by way of sale of equity or debt instruments, this may impact on its stock price based on market perception and the funds raised cash purposes – growth, acquisitions, etc.

ICICI Bank Share Price Target 2028

ICICI Bank share price target 2028 the expected price is ₹1890.

Here are the key aspects affecting the growth of ICICI Bank in 2028.

- Competition and Market Share: Relentless competition within the private and public sector, as well as non banking financial institutions will beacon worrying threats to ICICI bank’s market portion. A balanced strategic response will be central in retaining control.

- Global Financial Turmoil: The potential to get hit by ripple effect when any of the major economies tend to display signs of financial crisis as well as instability is high for Indian banks. In this case ICICI is expected to be very well capitalized as compared to others who will find it challenging.

- Credit Demand: For ICICI Bank, the growing credit demand especially for retail, MSME and infrastructure segments translates to an improvement in revenue growth resulting in a higher share price for the bank.

ICICI Bank Share Price Target 2029

ICICI Bank share price target 2029 the expected price is ₹2050.

Here are the key aspects affecting the growth of ICICI Bank in 2029.

- Financial Indicators: ICICI Bank’s market expansion capability will also be determined by its efforts made towards sustaining or furthering its capital adequacy ratio and all its other indicators of financial health.

- Strategic Acquisitions/Partnerships: Strategic relationships or business mergers may create a tremendous impact on both asset and market share growth and thereby on the share price as well.

- Adoption of Green Finance: If ICICI Bank’s presence in these areas increases, then it might be expected that there will be a growth in the opportunities for investment in sustainable finance and ESG (Environmental, Social, and Governance) investment, which will appeal to investors that are environmentally friendly.

ICICI Bank Share Price Target 2030

ICICI Bank share price target 2030 the expected price is ₹2205.

Here are the key aspects affecting the growth of ICICI Bank in 2030.

- Long-Term Technological Integration: Investors are likely to find ICICI Bank’s performance on profitability, scale and risk management to be more appealing once ICICI Bank is fully transitioned into the digital space with AI technology integrated into the platforms of the bank.

- Economic Conditions: After a decade of growth, the standing of Indian economy globally will be important to know. Also, the systematical economic growth will be supportive of banks’ functions.

- Market Sentiment & Investor Confidence: In case of bullish market conditions, which are likely to remain, buyers’ market sentiments and general performance of the Indian market are predicted to affect the value of stock shares of ICICI Bank by 2030.

FAQ

What is the share price of ICICI Bank in 2025?

ICICI Bank share price is likely to be ₹1480 in 2025.

What is the share price of ICICI Bank in 2030?

ICICI Bank share price is likely to be ₹2205 in 2030.

What is the share price of ICICI Bank in 2026?

ICICI Bank share price is likely to be ₹1589 in 2026.