In this article you will get to know about NHPC Share Price Target 2025 To 2030. Here you will get the basic information of the company, analyze the share and see the market overview, price chart, financials and income report. And know the performance of NHPC Share from previous year and share the price target. By, this you will get to know about NHPC Share Price Target 2025 To 2030.

Table of Contents

NHPC Ltd.

NHPC Limited, a public sector enterprise, is a leading hydropower generation company in India, owned by the Government of India. It started operating in 1975, NHPC is engaged in construction of hydropower projects and generation of energy from renewable sources. It occupies a very important place in India’s energy sector system by contributing a sizeable share in energy generation in the country, particularly in renewable and hydropower energy generation. For more information you can visit https://www.nhpcindia.com/.

NHPC Fundamentals and Market Overview

- 52 Week High: ₹118.40

- 52 Week Low: ₹85.55

- Volume: 2,52,01,333

- Market Capital: ₹87,151Cr

- ROE: 7.42%

- Book Value: ₹39.97

- Face Value: ₹1o

- EPS(TTM): ₹2.97

- P/E Ratio(TTM): 29.21

- Industry P/E:24.01

- Dividend Yield: 2.19%

- Debt to Equity: 0.85

NHPC Share Price Chart

NHPC Share Price Target 2025 to 2030

| NHPC Share Price Target Years | Share Price Target (₹) |

| 2025 | ₹132 |

| 2026 | ₹156 |

| 2027 | ₹188 |

| 2028 | ₹270 |

| 2029 | ₹295 |

| 2030 | ₹319 |

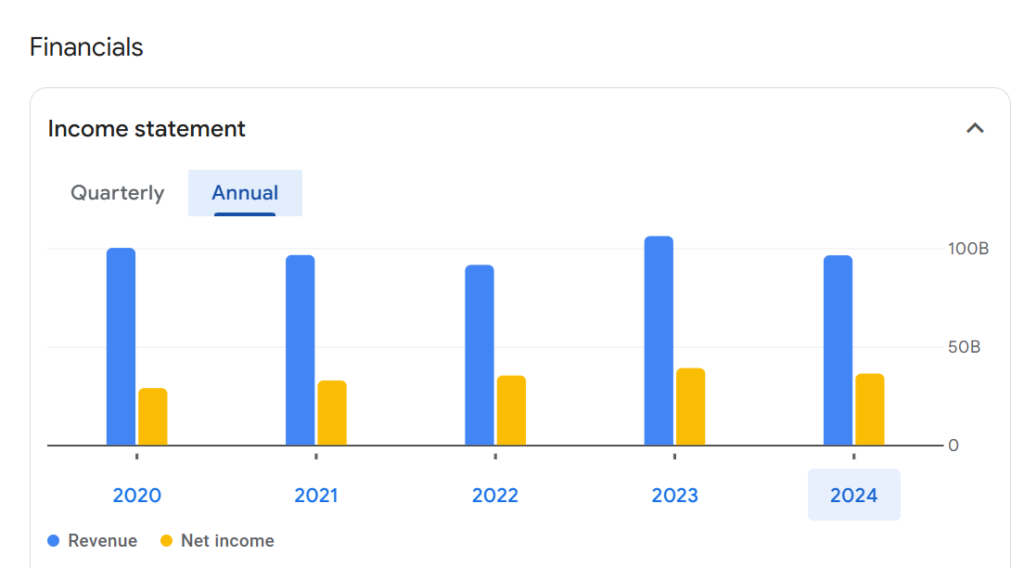

NHPC Financial and Income Statement

| (INR) | 2024 | Y/Y change |

| Revenue | 96.32B | -9.19% |

| Operating expense | 39.71B | -9.58% |

| Net income | 36.24B | -7.14% |

| Net profit margin | 37.63 | 2.26% |

| Earnings per share | 3.61 | -6.72% |

| EBITDA | 59.27B | -7.41% |

| Effective tax rate | 20.13% | —– |

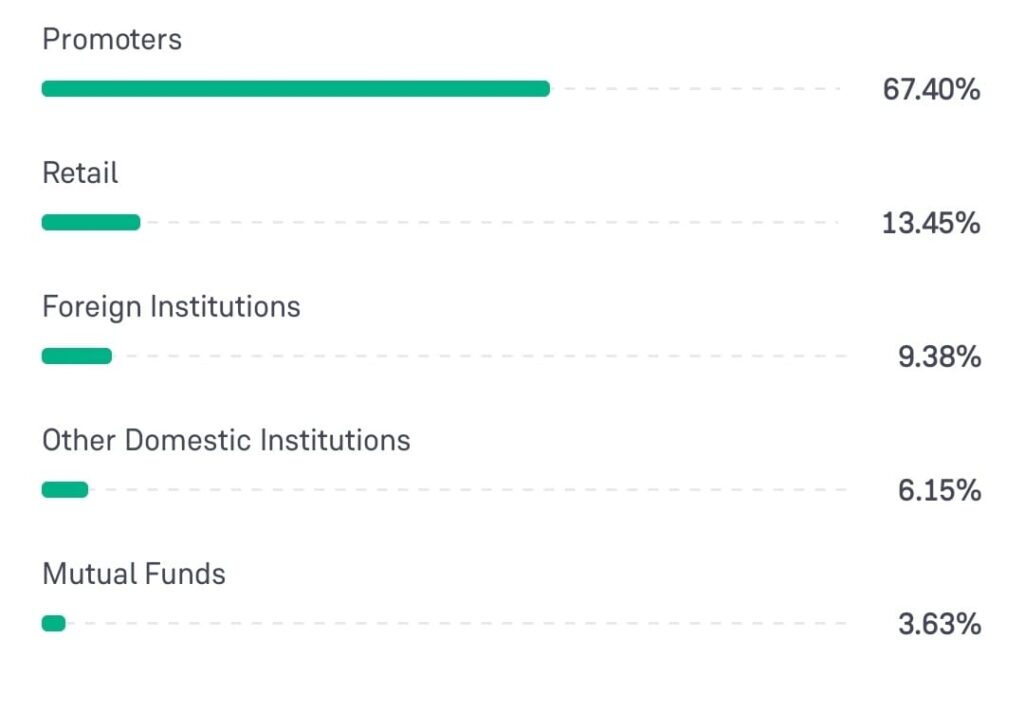

Share Holding Pattern of NHPC

- Promoters: 67.40%

- Retail: 13.45%

- Foreign Institutions: 9.38%

- Other Domestic Institutions: 6.15%

- Mutual funds: 3.63%

NHPC Share Price Target 2025

NHPC share price target 2025 the expected price is ₹132.

Here are the key aspects affecting the growth of NHPC in 2025.

- Project Execution and Capacity Additions: NHPC is expected to be nearing completion of the major ongoing hydroelectric projects including the Subansiri Lower project, as well as the commissioning of these plants. The project delays and if the projects are finished on time will be followed.

- Government Policy: The plans drawn by the Government of India to achieve 175 GWs of Renewable Energy capacity by 2022 and in the long term, further expanding this capacity by 2030 provides an additional growth thrust to NHPC especially in case, NHPC ventures into solar or wind energy.

- Hydropower Policy: The government’s push for sustainable hydroelectric energy supply along with any subsidies or policies that might be in place, will be favorable for NHPC. There could also be grants for creating new plants in the targeted zones for achieving renewable energy objectives.

- Monsoon and Hydrological Risks: The water availability levels will have a direct relation with the revenue business capacity of NHPC with the operating hydro plants in the country. NHPC is likely to witness good stock price performance in the year of favorable monsoons, while a bad monsoon may lower the volume and negative the investor’s view on the company.

NHPC Share Price Target 2026

NHPC share price target 2026 the expected price is ₹156.

Here are the key aspects affecting the growth of NHPC in 2026.

- Revenue and Profit Growth: It is expected that by 2026, NHPC could start to depict a fuller picture of its growing volumetric generation capabilities and whether or not some of the newer projects funded are worth the investment. A steady financial performance particularly, an increase in revenue and profits, will tend to encourage investors as well.

- Diversification and Green Energy Initiatives: NHPC could start moving into solar or wind, which the market view as diversification or expansion. There could be stock appreciation based on any government encouragements towards additions on the renewable capacity apartheid.

- Capital and Debt Management: The spotlight will turn to NHPC’s capacity to operate its capital structure efficiently. Any negative sentiment regarding escalated debt borrowings or cost of borrowings could affect the bonus prospects.

- Risk from Competition: Private sector players in the energy generation matrix may gradually start eroding NHPC’s market share. It would be important for NHPC to remain competitive among its peers for growth in the renewable sector.

NHPC Share Price Target 2027

NHPC share price target 2027 the expected price is ₹188.

Here are the key aspects affecting the growth of NHPC in 2027.

- Project Completions and New Additions: NHPC is likely to have completed meaningful hydroelectric and renewable works by 2027 and position itself as an organization that is more diversified from the other participants in the renewable energy economy in India. Any successful signing of timestamps for the launching meetings of the country or projects will lead to appreciation of share prices.

- Government Support for Renewable Energy: Since there are concerns that India could become the top relative nation in clean energy around the globe, it could increase its support for HYDROELECTRIC and other related projections. This would enhance the growth of NHPC and its profit.

NHPC Share Price Target 2028

NHPC share price target 2028 the expected price is ₹270.

Here are the key aspects affecting the growth of NHPC in 2028.

- Regulatory Risks and Policy Changes: The Indian government’s focus on increasing climate change agenda may result in the NHPC increasing the operational cost of the hydropower projects. Missing out on any anticipated cash inflows, including approvals based, can hurt share price.

- Global Energy Trends: In a scenario of increasing energy costs globally or scarcity of fuels within the country, NHPC may emerge as one of the beneficiaries on the demand side for clean energy based options. The sentiments of the market toward NHPC being one of the leaders in the energy highway could be excellent.

- Debt and Dividend Strategy: By then, NHPC should be in a position to repay debt and continue its desire to remain attractive dividend payout company in order to capture investor interest. Increased concern of excessive leveraging or decrease in dividend yield could impair stock performance.

- Energy Storage: NHPC’s growth prospects could hinge upon any further investment within this space, particularly if this growth model involves integrating or extending the operations into pumping or storage with the aim of increasing renewable energy factors. It would be seen as a good growth model in the long term if the company decides to focus on this market.

- Debt and Credit Rating: How NHPC is rated including its debt, its servicing and even its credit rating will have a greater bearing on investor sentiment. Increased debt levels would have detrimental outcomes on share prices if it rises excessively.

NHPC Share Price Target 2029

NHPC share price target 2029 the expected price is ₹295.

Here are the key aspects affecting the growth of NHPC in 2029.

- Energy Storage: NHPC’s growth prospects could hinge upon any further investment within this space, particularly if this growth model involves integrating or extending the operations into pumping or storage with the aim of increasing renewable energy factors. It would be seen as a good growth model in the long term if the company decides to focus on this market.

- Debt and Credit Rating: How NHPC is rated including its debt, its servicing and even its credit rating will have a greater bearing on investor sentiment. Increased debt levels would have detrimental outcomes on share prices if it rises excessively.

NHPC Share Price Target 2030

NHPC share price target 2030 the expected price is ₹319.

Here are the key aspects affecting the growth of NHPC in 2030.

- Mature Renewable Portfolio: By 2030, NHPC could attain a high level of diversification as it might have a number of hydropower, solar, wind and storage projects in its portfolio. If the strategy of the company has evolved to become an integrated renewable energy provider, the stock price may benefit considerably.

- Energy Market: The energy market in India may become more freer including bringing in more private or foreign companies. The ability of NHPC to operate in such a scenario and sustain its market share would also be important.

- ESG Performance: If we take trends around 2030 into account, it is highly likely that the main focus shall be placed on sustainable investing, as well as NHPC’s ability to satisfy ESG (environmental, social, and governance) criteria, which will have a significant impact on the company’s share price. The view appears reasonable for there are significant allocations for investment in ESG funds which target clean energy leaders.

FAQ

What is the share price of NHPC in 2025?

NHPC share price is likely to be ₹132 in 2025.

What is the share price of NHPC in 2030?

NHPC share price is likely to be ₹319 in 2030.

What is the share price of NHPC in 2026?

NHPC share price is likely to be ₹156 in 2026.